By Luisa Maria Jacinta C. Jocson, Reporter

TOTAL RESOURCES of the Philippine financial system rose by 10.5% to P32.1 trillion at the end of July from a year earlier, central bank data showed, with enough cash, savings and credit lines available to people and organizations.

Banking resources alone climbed by 12.3% to P26.779 trillion year on year. Resources held by universal and commercial banks jumped by 12.4% to P25.101 trillion, while thrift banks’ resources rose by 10.1% to P1.114 trillion.

Month on month, financial system resources, which include funds and assets such as loans, deposits, capital and debt securities that can be converted into funds when needed, dipped by 0.7% from P32.332 trillion.

At end-July, the resources of digital banks surged by 29.3% year on year to P106 billion. The BSP only started collecting data from digital lenders in March 2023.

There were no updated data for rural and cooperative banks, as well as nonbank financial institutions.

Rural and cooperative lenders held P458 billion in resources at end-March, while the resources of nonbank financial institutions stood at P5.323 trillion. Nonbanks include investment houses, finance companies, security dealers, pawnshops and lending firms.

Institutions such as nonstock savings and loan associations, credit card companies, private insurance firms, the Social Security System and the Government Service Insurance System are also considered nonbank financial institutions.

The rise in financial system resources reflects the double-digit growth in bank lending amid easing inflation, said Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp.

Outstanding loans of universal and commercial banks rose by 10.4% year on year to P12.14 trillion. This was the fastest growth since 13.7% in December 2022.

“Further cuts in local policy rates, largely as a function of Fed rate cuts in the coming months, would lead to faster growth in loans, trading gains and other investment income of banks, all of which would lead to faster growth in banks’ total assets,” Mr. Ricafort said.

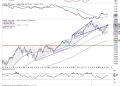

Fed fund futures showed traders are pricing in a 59% chance of a 50-basis-point (bp) cut at the September meeting, according to CME FedWatch. Futures priced a total of 125 bps in rate cuts in 2024, Reuters reported.

The US central bank is set to have its next meeting on Sept. 17-18.

BSP Governor Eli M. Remolona, Jr. earlier signaled another 25-bp rate cut in the fourth quarter.

The Monetary Board cut rates by 25 bps at its meeting last month, bringing the benchmark rate to 6.25% from 6.5%.

“Continued growth in banks’ earnings — banks have been among the most profitable, if not the most profitable industry in the country for many years — also added to capitalization and total resources,” Mr. Ricafort added.

The Philippine banking industry’s combined net income rose by 4.1% year on year to P190.21 billion at end-June, data from the central bank showed.