THE PHILIPPINES obtained a record $3.13 billion (P174.23 billion) from multilateral lenders to fund projects aimed at mitigating the effects of climate change, the European Investment Bank (EIB) said.

The 2023 total was 7.67% higher than the $2.91 billion obtained in 2022, according to the EIB’s 2023 Joint Report on Multilateral Development Banks’ (MDB) Climate Finance.

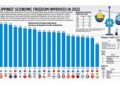

Among 126 countries, the Philippines was 11th highest recipient of climate finance, behind France ($7.38 billion), Spain ($6.98 billion), Italy ($6.67 billion), India ($6.5 billion), Poland ($5.81 billion), and Germany ($5.66 billion).

Also ahead of the Philippines were Turkey ($5.3 billion), Indonesia ($3.88 billion), Bangladesh ($3.72 billion), and Brazil ($3.61 billion).

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said this was “consistent with the fact that the Philippines has always been one of the hardest hit by calamity damage worldwide, including those related to climate change or extreme weather conditions.”

“(The) level of assistance to the country is commensurate to this fact, especially related to increasing preparedness of the country to face these climate-change related calamities to mitigate loss to property and lives,” he said via Viber.

For the 16th straight year, the Philippines was ranked the most disaster-prone country in the world with a risk score of 46.91, according to the 2023 World Risk Index.

In 2023, multilateral development banks (MDBs) allocated $125 billion for climate mitigation and adaptation projects worldwide, almost double their commitment to allocate $65 billion yearly until 2025.

The European Union received the highest climate financing from MDBs last year at $46.31 billion, followed by Sub-Saharan Africa ($17.24 billion), and East Asia and the Pacific ($11.12 billion), according to the report.

“We welcome the fact that MDBs provided record climate finance last year — every dollar of which makes a difference in helping to cut carbon emissions or preparing people and infrastructure for the worst impacts of climate change, much of which we must recognize is already baked in,” Bruno Carrasco, director general for Sustainable Development and Climate Change at the Asian Development Bank, said in a statement.

Despite this, Mr. Carrasco noted the still “large financing gap, and ADB will continue to work closely with other MDBs — and in its own right — to get as much financing as possible to our developing member countries.”

Low and middle-income countries, which include the Philippines, received $74.4 billion in 2023. Some 67% or $50 billion was allocated to climate change mitigation, while 33% or $24.7 billion was for adaptation.

Meanwhile, high-income economies obtained $50.3 billion from MDBs, with 94% or $47.3 billion going to mitigation projects and 6% or $3 billion going to adaptation projects.

The joint report combined climate funding extended by the EIB, ADB, African Development Bank (AfDB), Asian Infrastructure Investment Bank (AIIB), Council of Europe Development Bank (CEB), European Bank for Reconstruction and Development (EBRD), the EIB, Inter-American Development Bank (IDB), Islamic Development Bank (IsDB), New Development Bank (NDB) and the World Bank Group (WBG). — Beatriz Marie D. Cruz