Two topics will be covered in this column so we go straight to the numbers and facts.

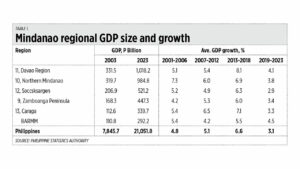

The Bangsamoro Autonomous Region in Muslim Mindanao (BARMM) has the smallest regional GDP size even among Mindanao’s six regions — only P292 billion in 2023 (at constant 2018 prices). The region has remained economically undeveloped even after the conclusion of the comprehensive peace agreement between the Philippine government and the Moro Islamic Liberation Front (MILF) in March 2014.

The BARMM is composed of six provinces — Lanao del Sur, Maguindanao del Norte (except Cotabato City), Maguindanao del Sur, Basilan, Tawi-Tawi, and Sulu. The regional GDP of P292 billion was only 1.4% of the total Philippine GDP of P21.05 trillion in 2023. I was expecting that during and after the peace agreement in 2014, regional growth would quickly rise but it did not. The average growth in 2013-2018 was only 5.5% compared with the national growth of 6.6% (see Table 1).

Recently the Supreme Court ruled that Sulu (with a population of 1 million according to the 2020 census) is no longer part of the BARMM, so the region now has only five provinces.

Last week I read about and saw photos of a big meeting, the 20th meeting of the National Government — Bangsamoro Government’s Intergovernmental Relations Body (IGRB) held on Oct. 11 at Chardonnay de Astoria in Pasig City. (It is a good venue, part of the Astoria Hotels and Resorts group owned by a friend and fellow UP School of Economics alumnus, Jeffrey Ng.)

Department of Budget and Management (DBM) Secretary and IGRB Co-chair Amenah F. Pangandaman, and BARMM Minister and IGRB co-chair Mohagher M. Iqbal, led the meeting. Secretary Pangandaman is also a Muslim — her family hails from Marawi City.

Both officials emphasized the role of peace or the absence of war in the region to advance growth and prosperity. The BARMM needs to be on a fast track growth and investment expansion to catch up economically even with its neighbor regions in Mindanao.

Here are some reports this year from BusinessWorld on this topic: “Bangsamoro ecozones backed” (Jan. 14), “Gains mark BARMM’s 5th year” (Jan. 21), “Energy dep’t, BARMM to offer areas for exploration” (Feb. 26), “Bangsamoro gov’t authorized to enter into foreign-aid deals under new ODA guidelines” (Sept. 3), “BARMM to buy DBP stake in Amanah Bank” (Sept. 9), “BARMM studying Malaysia’s programs” (Oct. 1), “Exploring land-based natural gas fields in Southern Mindanao” (Oct. 14, “Introspective” column by Dr. Ramon Clarete), “SC ruling on Sulu won’t disrupt gov’t operations — IGRB” (Oct.15).

I hope that the recent IGRB meeting and the inspirational messages of Ms. Pangandaman and Mr. Iqbal will spur the participants and their people in the region to move faster in attracting domestic and foreign investments. Especially huge funds from rich Muslim economies in the Middle East like Qatar, Kuwait, the United Arab Emirates, and Saudi Arabia.

THE US ELECTIONSThe US Presidential elections are just three weeks away, so I checked the fiscal management records of past American presidents Barrack Obama and Donald Trump, and incumbent President Joe Biden.

Since Mr. Trump had an explicit policy of “no new US war abroad” coupled with ending existing US wars, the man has actually controlled the fast expansion of US debt, with an average increase of only around $3.15 trillion over three years (2016-2019) or $1 trillion/year.

Then came the COVID-19 lockdowns and mandatory shutdown of businesses globally in 2020. US debt jumped by $4.2 trillion in a single year to $26.94 trillion by the end of Fiscal Year 2019-2020.

President Biden and Vice-President Kamala Harris backed a new US war/involvement abroad in Ukraine, sustained existing wars (US troops are still in Syria, Iraq, etc.), and are preparing for a big war vs China over Taiwan. US public debt has been increasing, from $1 trillion/year under Trump (except for 2020) to $2.13 trillion/year under Biden (see Table 2).

These public debt numbers do not include yet unfunded liabilities like pension which are in the several tens of trillion dollars.

The world has experienced 79 years of peace, with no world wars (from September 1945, when World War II ended, to October 2024). Conflicts between and among countries over territory, over natural resources and other issues were resolved via diplomacy and peaceful settlement. Yes, there were inter-country or regional wars but no world war.

We should keep peace in the world. We should have more commerce and trade, more investments and tourism, more exchange of sports, culture, and rock bands in the world. Not more missiles and bombs, more jetfighters and fighter drones.

I hope that we shall see a no new war, and see policy change on existing wars in the US again after the Nov. 5 elections.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.