Last week a huge business delegation organized by the Canadian Embassy — the Team Canada Trade Mission (TCTM) — came to Manila. Upon the invitation of the embassy, I attended the Plenary Session, “Canada, the Philippines and the Indo-Pacific,” on Dec. 5 at the Grand Hyatt Hotel ballroom. It was full, with some 300 Canadian plus 400 Philippine business leaders, plus government officials from both countries in the room.

Keynote speakers were Minister Mary Ng of Canada’s Ministry of Export Promotion, International Trade and Economic Development, and Secretary Frederick D. Go, Special Assistant to the President for Investment and Economic Affairs of the Philippines. I also attended the TCTM gala dinner that day at the PICC.

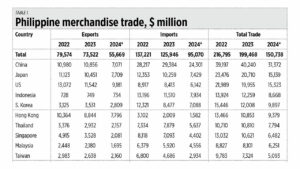

Trade between the Philippines and Canada is not big yet. Data from the Philippine Statistics Authority (PSA) show that total merchandise trade (exports plus imports) was only $1.49 billion in 2023 and $1.05 billion in January-September 2024. The top three trade partners of the Philippines still are China, Japan, and the US, while other Asian neighbors fill up the top 10 (see Table 1).

Special credit goes to the Ambassador of Canada to the Philippines David Hartman, and Trade Counselors Eleonore Rupprecht, Guy Boileau and their staff for their hard work promoting the Philippines to Canadian business people. Thank you, Sirs, Madam.

INFLATIONLast week the PSA released the country’s inflation and labor data. The inflation rate in November was 2.5%, lower than the November 2023 level of 4.1%. The January-November average is now 3.2%.

The government economic team was understandably bullish. Finance Secretary Ralph G. Recto said that “We are very much on track in keeping our inflation within our target band for the entire year despite some challenges, such as strong successive typhoons that affected the agriculture sector.

“Economic Planning Secretary Arsenio M. Balisacan said that they focus on “price stability supported by prudent monetary policies and strategic trade measures in the near term, as well as improved access to quality job opportunities and productivity-enhancing reforms.”

Budget Secretary Amenah F. Pangandaman said that “public spending that raise agriculture and overall productivity especially infrastructures that facilitate faster mobility of goods and people continue to be prioritized to help stabilize prices and adequate supply of commodities.”

Later this week I will go to Argentina to meet some fellow free market leaders from other countries around the world. The choice of Argentina as the venue for the event was good because in November 2023, the people of Argentina elected a very articulate and dynamic leader, President Javier Milei.

Argentina has suffered from hyperinflation for many years, up to 133% in 2023 alone. Big government bureaucracies and spending that required heavy borrowing and money printing led to high interest and inflation rates. President Milei cut many subsidies and freebies, and certain bureaucracies, and this led to a sustained budget surplus this year.

I compared the budget balance of Argentina with five other large Latin American countries — Brazil, Mexico, Colombia, Chile, and Peru. All of them, especially Mexico, continue to suffer from large budget deficits. Argentina is the new odd-man-out in a positive way (see Table 2).

From the early to middle part of this year, Argentina’s inflation rate reached up to 200%+ mainly because President Milei removed price controls and slashed subsidies of various commodities and public services. But the inflation rate has since started to mellow. The fiscal surplus should lead to less borrowing, lower interest payments, and more public resources to finance public infrastructure that can reduce inflation pressure.

The Philippines has been moving to more market-oriented reforms, including the corporate income tax cut from 25% to 20% under the CREATE MORE (Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy) law. Argentina is also moving towards more market reforms. There should be synergy between both countries if they enter into more bilateral trade and investment partnerships.

Those sectors should include energy, and Argentine exports of beef, poultry, and pork. Their nuclear technology — applications in power generation, medicine and healthcare, agriculture, etc. — plus satellites and biotechnology, forensic anthropology, should be something that we can learn from and tap.

Argentina can also tap the Philippines’ electronics products and exports — tropical fruits — among others. The list between two market-oriented emerging economies on both sides of the Pacific can truly expand.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.