The big public backlash against the proposed budget for 2025 was triggered by the big reductions made this month by the Bicameral Conference Committee from the proposed budget submitted last August: that of the Department of Social Welfare and Development (DSWD) was reduced by nearly P100 billion (its Ayuda sa Kapos Ang Kita Program or AKAP was cut by P12.8 billion, 4Ps by P50 billion, others by P33 billion), the Philippine Health Insurance Corp. or PhilHealth’s budget was cut by P74.4 billion, the Pension and gratuity fund by P36 billion, the Commission on Higher Education’s (CHED) was cut by P26.9 billion, the Department of Health (DoH) by P25.8 billion, the Department of Agriculture (DA) by P20 billion, and the Department of Labor and Employment (DoLE) by P18 billion, among others.

Then the Bicameral Committee significantly increased the budgets for the following: unprogrammed appropriations were increased by P373 billion, the Department of Public Works and Highways (DPWH) by P288.7 billion, Congress’ own budget was increased by P18.8 billion, and the allocation to local government units (ALGUs) went up by P10.6 billion, among others.

My quick reaction to the cuts in the budgets of the social agencies (DSWD, the Department of Education or DepEd, DoH, State Universities and Colleges, among others) is that this should have been done in 2022 or 2023, not 2025. There were big increases in their budgets in 2020 to 2021 because of lockdown, the virus crisis leading to an economic crisis, so the big increases were understandable.

But there was no more virus crisis and economic crisis in 2022 and beyond, but heavy welfare spending funded by heavy borrowing continued which should not have been done.

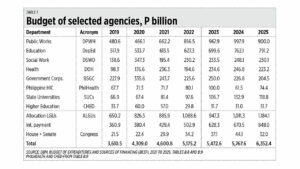

The DoH experienced a big jump in its budget, from P98 billion in 2019 to P177 billion in 2020, and P236 billion in 2021. The DSWD also experienced a big jump, from P139 billion in 2019 to P347 billion in 2020, and P230 billion in 2022. DepEd has had consistent increases in its budget. PhilHealth’s went up from P68 billion in 2019 to P80 billion in 2022 and P100 billion in 2023 (see Table 1).

Meanwhile, government revenues suffered heavy declines in 2020 due to the lockdown and the mandatory shutdown of taxpaying businesses and people. Revenues fell from P3.13 trillion in 2019 to only P2.86 trillion in 2020 and P3 trillion in 2021.

The budget deficit increased, from P660 billion in 2019 to P1.37 trillion in 2020, P1.67 trillion in 2021, and P1.61 trillion in 2022. Financing or borrowings increased from P876 billion to an average of P2.2 trillion yearly from 2020 to 2023. Interest payments from higher public borrowings jumped from P360 billion in 2019 to P503 billion in 2022 and are projected to reach P767 billion in 2024 (see Table 2).

I support the reduction in the budgets of many social agencies, but I do not support the increase in those of other sectors, particularly the DPWH and the unprogrammed appropriations.

There should be forced savings via the consistent reduction in the budget of many welfare agencies because high public debt, high interest rates, and high interest payments have big “diswelfare” effects on the poor themselves.

Last week I went to Buenos Aires, Argentina, to attend the Tholos Forum 2024. I was with fellow leaders of free market think tanks, institutes and taxpayers’ associations from many countries in South America, North America, and Europe. I was the only participant from Asia. The local sponsor of the Tholos Foundation was the Argentina Taxpayers Association.

Many of the speakers were high officials and legislators from La Libertad Avanza, the political party of Argentina’s new president, Javier Milei. Argentinians suffered from horrible high inflation for decades under previous administrations. There were huge, wasteful, and corrupt bureaucracies, the irresponsible printing of money, and a great deal of cronyism in business.

Milei cut the number of Ministries or Departments in government from 19 to nine. He abolished 10 Ministries, not just reduced the budgets of these agencies. He attained a fiscal surplus for Argentina within two months of his administration. This year is the first time in 123 years that Argentina will experience a budget surplus and economic recovery has been visible: inflation has been declining, there has been GDP growth and an escape from recession, business confidence is improving. He is now on another path to reduce the number of taxes and reduce tax rates.

The Philippines need not follow Argentina’s hard U-turn in public spending, but big reforms in social spending are possible because we are not in any crisis, viral or economic. We should do this before a real fiscal crisis occurs if the consistent increase in our public debt stock is not controlled.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.