Here is my list of the major economic developments in 2024; the first five are global and the next five are Philippines specific.

1. The top three fastest growing major economies are Vietnam, India, and Philippines. Major economies are those in the list of the Top 50 countries with the largest GDP size in the world. The average GDP growth of Vietnam, India, and the Philippines in the first three quarters (Q1-Q3) in 2024 were 6.8%, 6.6%, and 5.8%, respectively.

2. The slowest growing, and often contracting, major economies in the world were European. In particular Ireland, Austria, and Germany. Also, Russia’s neighbors Finland, Latvia, and Estonia contracted by -0.7%, -0.9%, and -1.2% respectively over the first three quarters (Q1-Q3) in 2024. Japan was the only major Asian country that experienced an economic contraction in 2024.

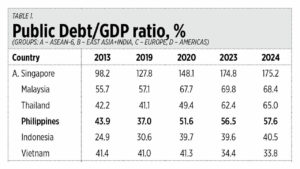

3. The inflation rate was decelerating in many countries (exceptions were Vietnam and Russia). Most European nations significantly reduced their inflation rate in 2024 relative to 2023 but suffered low growth or economic contraction in exchange (see Table 1).

4. The election of Donald Trump and more business optimism. The last time the US grew by 3% or higher was in 2018 (under the Trump administration) with 3% and in 2005 (the Bush Jr. administration) with 3.5%. The average US inflation in 2017-2020 (Trump) was 1.9%, and in 2021-2024 (Biden administration) it was 4.9%.

5. Continued wars abroad dampen global economic sentiments. I was expecting that the unwinnable war in Ukraine, the Israel-Hamas/Hezbollah war would end in the middle to late 2024. I was wrong. I can only hope that Trump’s “no new war” policy which he followed in his first term (there were no new US wars from 2017-2020) will kick off early because all the big wars in the world now have huge US involvement.

6. The Philippines’ GDP growth failed to reach the 6% target. The high inflation of 2023 dampened household consumption, which constitutes 73% of GDP, until 2024. But as shown in Table 1, the 5.8% growth in Q1-Q3 was still fast and strong by global standards.

7. Investments or capital formation recovered to grow by 8%. Investments constitute 24% of GDP. Construction, both government and private, maintained its double-digit growth.

8. Industry and services sectors pulled up overall growth as agriculture remained weak or understated. The series of strong storms with actual landfalls in September affected the country’s crops and livestock (see Table 2).

9. The Philippines Economic Briefing (PEB) abroad highlighted the country’s economic opportunities. The government’s economic team — composed of Finance Secretary Ralph G. Recto, Budget Secretary Amenah F. Pangandaman, Economics Secretary Arsenio M. Balisacan, Presidential Assistant for Investments Frederick Go, and Bangko Sentral Governor Eli Remolona — conducted a PEB in London and investors meetings in Washington DC last October. As shown in Table 1, the UK and many major European economies are either crawling or contracting, many companies there are shutting down or migrating abroad and Philippines should be one of their destination countries.

10. Large investment projects were encouraged by the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) law, the Public-Private Partnership (PPP) Code, and related legislation. CREATE MORE (RA 12066, November 2024) and PPP Code (RA 11966, December 2023) have expanded fiscal incentives like reduction in corporate income tax from 25% to 20%, and removed uncertainties in PPP infrastructure investments.

I commend the economic team, particularly Secretaries Pangandaman, Balisacan, Recto, Go, plus PPP Center head Cynthia Hernandez. We need more job-creating investments and infrastructure projects without the need for additional taxation, borrowing, and state-dependent welfare.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.