YIELDS on government securities (GS) traded in the secondary market were mostly mixed last week amid weak market activity following the holidays.

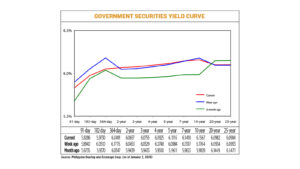

GS yields, which move opposite to prices, inched down by an average of 1.87 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Jan. 3 published on the Philippine Dealing System’s website.

Rates at the short end of the curve declined, with the 91-, 182-, and 364-day Treasury bills (T-bills) decreasing by 6.54 bps (to 5.8286%), 7.8 bps (5.9730%), and 12.85 bps (6.0491%) week on week, respectively.

Meanwhile, at the belly, yields rose across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their rates increase by 2.04 bps (to 6.0657%), 2.26 bps (6.0755%), 1.77 bps (6.0925%), 1.32 bps (6.1116%), and 0.21 bp (6.1418%), respectively.

The long end saw mixed yield movements. The rates of the 20- and 25-year T-bonds inched up by 0.48 bp and 0.51 bp to 6.0928% and 6.0984%, respectively. Meanwhile, the 10-year T-bonds went down by 1.97 bps to fetch 6.1567%.

GS volume traded reached P31.34 billion on Friday, higher than the P29.61 billion recorded a week earlier.

“With no new data released and a shortened trading week locally, we saw relatively subdued activity from the local market. Today, local yields broadly declined, closing 3-7 basis points lower. This decline was driven by demand from offshore investors, providing a supportive tone to the market,” ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in a Viber message on Friday.

“There was quite minimal movement in yields during the shortened trading week. However, the movement seemed to have reflected investor expectations on inflation and policy decisions by central banks this year,” a bond trader said.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., said rates of shorter tenors mostly went down as the market expects Philippine headline inflation to remain low, which could support further Bangko Sentral ng Pilipinas (BSP) rate cuts this year.

While December inflation could have picked up from the November level, this likely remained within the BSP’s 2-4% target, Mr. Ricafort said.

A BusinessWorld poll of 13 analysts yielded a median estimate of 2.7% for the December consumer price index (CPI), within the BSP’s 2.3%-3.1% forecast for the month.

If realized, this would be faster than the 2.5% in November and mark the third straight month of acceleration. Still, this would be slower than the 3.9% recorded in the same month in 2023.

The Philippine Statistics Authority will release December and full-year 2024 inflation data on Jan. 7 (Tuesday).

For the full year, the BSP expects the CPI to average 3.2%.

The BSP’s policy-setting Monetary Board has slashed benchmark borrowing costs by a total of 75 bps since it began its rate-cutting cycle in August 2024.

BSP Governor Eli M. Remolona, Jr. last month said that while they remain in an easing cycle, 100 bps worth of cuts this year may be “too much” amid inflation concerns.

Still, Mr. Remolona said the BSP is “neither more dovish nor less dovish” and is open to delivering another cut in their first policy meeting this year.

For this week, GS yields may continue to move sideways before the release of December inflation data, analysts said.

“Yields might move with an upward bias as the potentially stronger Philippine inflation and US labor reports might bolster views that the BSP and the US Federal Reserve could afford to pause with their rate-cutting cycles in their respective first policy meetings this year,” the bond trader said.

“Overall, yields may remain range-bound in the short term. We expect to see short-end rates likely to remain steady, while medium to long-tenor yields may rise in anticipation of increased bond supply… Should the CPI figure exceed market expectations, yields may still remain range-bound as any uptick in rates will be met with investors support, driven by persistent expectations of rate cuts throughout the year,” Mr. Ulpo said.

This week’s auction of reissued seven-year bonds could also affect yields as it would serve as a gauge of the market’s appetite for long-term papers, he added.

2025 OUTLOOKFor this year, the bond trader said GS yields may remain volatile as global central banks continue to adjust their monetary policy stance and as US President-elect Donald J. Trump assumes office.

“The local yield curve is expected to steepen further this year from the compounded effect of anticipated BSP rate cuts on short-term yields and growing inflationary concerns locally and globally, which could push long-term yields higher,” the bond trader said. “Market participants could experience more volatility in the bond market due to occasional market jitters from policy pronouncements by President Trump.”

Mr. Ulpo likewise said that policy guidance from the BSP could support short-end yields.

“On the contrary, concerns over bond supply and global rates volatility will continue to shape trading dynamics, keeping investors cautious particularly on duration,” he added.

The US Federal Reserve’s policy actions, which could be mirrored locally, could also affect GS yield movements this year, Mr. Ricafort said.

The Fed began its easing cycle in September 2024 with an outsized 50-bp cut and followed it up with 25-bp reductions at each of its November and December meetings, bringing the fed funds rate to 4.25%-4.5%.

Fed Chair Jerome H. Powell has signaled cautiousness about future cuts due to elevated inflation, with US central bank officials seeing just two 25-bp reductions this year. — Abigail Marie P. Yraola