Labour ministers are quietly stepping away from enforcing the previous government’s policy that civil servants must be in the office at least three days a week.

While the rule, introduced under the Conservatives, remains technically in place, ministers have indicated they have no interest in strictly policing office attendance.

This shift aligns with Labour’s broader push to expand flexible working rights, which ministers believe will boost productivity and spread economic growth across the country. Business Secretary Jonathan Reynolds has been vocal in his support for flexible working, arguing that it promotes staff loyalty and reduces the “culture of presenteeism” that prioritizes physical presence over performance.

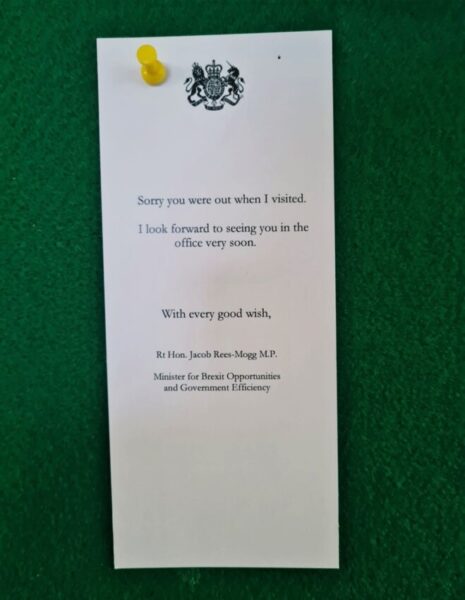

Reynolds has also criticized his predecessor, Sir Jacob Rees-Mogg, for his more rigid stance on home working, which included leaving notes on empty desks in Whitehall. Under Rees-Mogg, the civil service was expected to ensure that staff were in the office 60% of the time. However, Labour ministers, including Deputy Prime Minister Angela Rayner, have taken a more pragmatic approach, leaving decisions about work patterns to individual managers.

While this flexible approach has been welcomed by civil service unions, there is still some debate within departments about the balance between home and office work. For instance, a senior official in the Home Office recently expressed concern that remote work might be hampering performance in immigration enforcement.

In contrast to Labour’s stance, some private sector companies are moving in the opposite direction. Amazon, for example, recently announced that it will require employees to return to the office five days a week starting next year, citing the benefits of on-site collaboration and learning.

Kemi Badenoch, who has been critical of Labour’s approach, argued that more office time is necessary for skill development. She warned that Labour’s focus on flexible working could lead to a decline in learning opportunities and productivity.

Business groups, however, have largely supported the government’s flexible working policies, with the Institute of Directors and the Chartered Management Institute stressing that flexibility is crucial in addressing the UK’s labour shortages. They argue that flexible working options help attract and retain talented staff, though they caution that employers should retain the ability to deny requests that don’t align with business needs.

As Labour continues to refine its approach to flexible working, it remains to be seen how the policy will evolve and impact both the public and private sectors. For now, the government appears focused on promoting a flexible work culture, while ensuring that essential services remain effective.