THE ASSET QUALITY of Philippine banks is expected to improve in 2025, supported by strong economic expansion, loan growth and lower interest rates, Fitch Ratings said in a note on Thursday.

“We expect nonperforming loan (NPL) ratio improvements across five out of 14 larger Asia-Pacific markets in 2025 before rising to nine in 2026,” the credit rater said. “The largest near-term improvements are likely to be in India, Vietnam and the Philippines, mostly driven by robust economic expansion and loan growth, with the Philippines also benefiting from lower interest rates.”

Data from the Philippine central bank showed that the banking industry’s bad loan ratio rose to 3.6% in October from 3.47% in September and 3.44% a year ago. This was the highest bad loan ratio since May 2022, matching the June 2022 level.

Soured loans rose by 1.3% to P524.31 billion in October from P517.45 billion a month earlier. Year on year, bad loans jumped 16.7%.

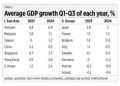

“We expect stable or declining credit costs in most Asia-Pacific banking systems due to gross domestic product growth and steady unemployment,” Fitch Ratings said.

The Development Budget Coordination Committee last week narrowed its growth target to 6-6.5% this year from 6-7% after slower-than-expected third-quarter growth.

Banks in emerging markets including the Philippines could also benefit from a potential increase in US tariffs due to a stronger dollar, which could prompt central banks to increase their borrowing costs.

“This would result in a positive impact on banking sector revenue,” the credit rater said. “Indonesia stands out as an exception, where banks generally benefit from lower rates due to their specific asset/liability configuration. Higher interest rates can lead to increased bank revenue, but they are also likely to inhibit loan demand and elevate asset-quality risks.”

The debt watcher also expects double-digit loan growth for Philippine lenders amid a higher risk appetite in the next two years due to robust economic growth, competition and expanding financial inclusion. These have motivated banks to tap riskier segments to boost their loan growth.

Fitch Ratings cited Philippine banks’ stronger appetite for higher-risk, unsecured retail loans and loans to small and medium enterprises.

However, the credit rater said they could face asset quality risks if the business environment becomes more volatile.

“Philippine banks have historically demonstrated greater vulnerability in a less benign environment, although mainly to segments other than the bigger banks’ exposure to large conglomerates,” it said. — Aaron Michael C. Sy